Insurance in Logistics: Necessity vs. Cost

How to Protect Your Shipments Without Breaking the Bank

In logistics, every shipment carries a story. Picture this: a container of high-end electronics setting sail from Mumbai to Rotterdam, or a truckload of life-saving pharmaceuticals navigating winding highways in monsoon season. Each journey holds promise — and risk. A single incident — a storm at sea, theft at a warehouse, or even a minor mishap during transit — can instantly turn a profitable deal into a financial nightmare.

Yet, surprisingly, many exporters and shippers treat cargo insurance as optional. There’s a common assumption that carrier liability will cover everything. Reality check: it rarely does.

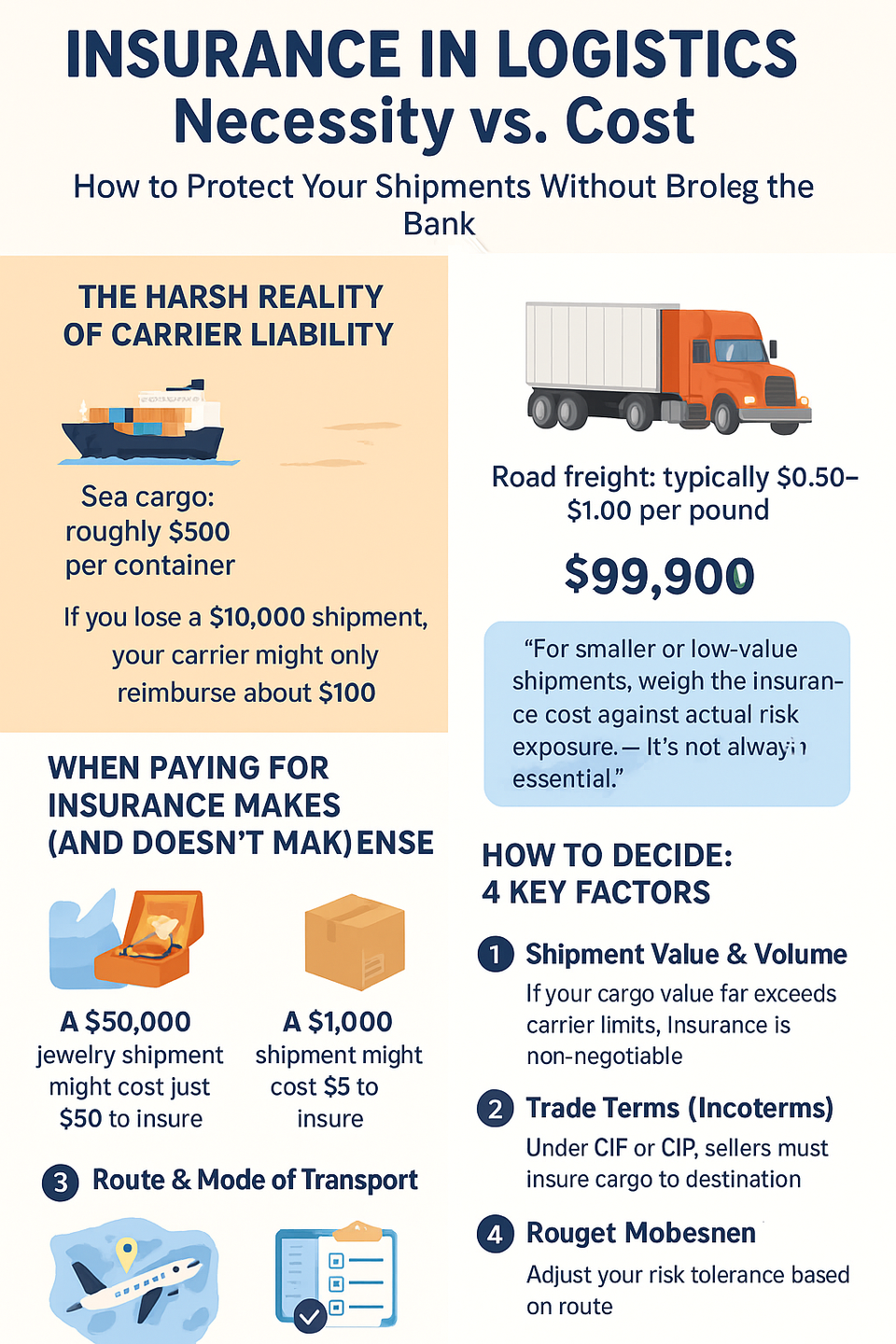

The Harsh Reality of Carrier Liability

Most carriers offer limited protection under standard liability laws:

● Sea cargo: roughly $500 per container

● Road freight: typically $0.50–$1.00 per pound

Imagine losing a $10,000 consignment of electronics. Your carrier might reimburse about $100. That leaves $9,900 hanging in the balance — a sum that could wipe out months of profit.

As logistics experts often warn:

“Relying solely on carrier coverage can lead to unrecoverable losses.”

It’s a harsh lesson many learn too late.

When Paying for Insurance Makes (and Doesn’t Make) Sense

Not every shipment needs full coverage. But for high-value, fragile, or critical cargo, the cost of insurance is usually negligible compared to the potential loss.

Most insurers charge 0.05%–0.25% of cargo value, often with a small minimum fee. For example:

● A $50,000 jewelry shipment might cost just $50 to insure — a small price for peace of mind.

● A $1,000 shipment might only cost $5, which may seem unnecessary unless risks are high.

Freight professionals often follow this golden rule:

“For smaller or low-value shipments, weigh the insurance cost against actual risk exposure — it’s not always essential.”

How to Decide: 4 Key Factors

1. Shipment Value & Volume

The higher the cargo value, the less room for compromise. Electronics, pharmaceuticals, luxury fashion — even one lost container can devastate a business. For bulk commodities like grains or minerals, carrier coverage may suffice.

2. Trade Terms (Incoterms)

Who bears responsibility? It depends:

● CIF or CIP: Sellers must insure cargo to the destination.

● FOB or EXW: Buyers typically handle insurance.

Always clarify responsibilities in contracts. Some corporate clients may even demand proof of insurance before release.

3. Route & Mode of Transport

Risk varies by route and mode:

● Airfreight or sea passages through piracy-prone regions = high risk

● Domestic trucking on stable routes = relatively safe

Factor in transfers, weather, or peak seasons. Even familiar routes can carry surprises — and insurance can be your safety net.

4. Shipment Frequency & Policy Type

Frequent exporters may benefit from annual or open cargo policies, often at discounted rates.

Occasional shippers can go for single-trip coverage.

A note of caution: some freight forwarders include insurance, but not all policies are equal. Always verify coverage terms, exclusions, and claims procedures before committing.

Strategic Takeaway

Cargo insurance is not an expense — it’s risk management. One mishap can erase months of profit and damage client trust.

Seasoned logistics professionals recommend:

● Always insure medium-to-high value shipments or critical cargo.

● Use insurance selectively for new routes, initial consignments, or peak-season shipments.

● Compare policies (all-risk vs. named-peril) and confirm global claims support.

In logistics, the smallest premiums often protect against the biggest regrets.

Final Word

Insurance in logistics isn’t about fear — it’s about foresight. It ensures that when things go wrong (and sometimes they do), your business continuity, client relationships, and profit margins stay intact.

As supply chains grow more complex, cargo insurance is no longer optional — it’s strategic. The smartest exporters don’t insure every shipment; they insure the right ones.